What is Curve Finance?

Curve Finance is a decentralized exchange that was initially introduced on the Ethereum network. It utilizes automated market maker technology (AMM-DEX). It was devised to facilitate transactions between stablecoins and other tokens of the same value in a time- and cost-effective...

Curve Finance is a decentralized exchange that was initially introduced on the Ethereum network. It utilizes automated market maker technology (AMM-DEX). It was devised to facilitate transactions between stablecoins and other tokens of the same value in a time- and cost-effective manner, with a minimum of slippage and fees.

Curve is managed by the decentralized autonomous organization known as Curve DAO. This organization is made up of people who own the CRV governance token.

Curve is one of the leading DeFi protocols in terms of the number of active users and the number of smart contract lock-ups (TVL).

How Does Curve Work?

The trading of assets in Curve Finance is conducted using liquidity pools, much like it is in other AMM-DEXs. These are smart contracts that hold two or more assets in equal portions and let users to exchange them automatically through a straightforward interface by connecting with any Web3 wallet.

A mathematical formula is used to compute relative asset prices, and the magnitude of slippage (price changes) that occurs during the exchange has an inverse connection with the size of the pool.

One of the earliest pools to be established was called 3Pool, and it holds equal amounts of DAI, USDC, and USDT. Later on, pools for exchanging other stablecoins, such as BUSD, TUSD, HUSD, and USDN, as well as linked wrapped tokens, such as wBTC and renBTC, came into existence.

A commission of 0.04% of the total transaction volume is levied against each exchange that operates on the platform. A portion of this commission is then split among the various liquidity providers. Any user that contributes assets to the pool is eligible to get a portion of the fees that are collected. Beginning on the 13th of August in the year 2020, those that supply liquidity will be eligible to win additional benefits in the form of CRV tokens.

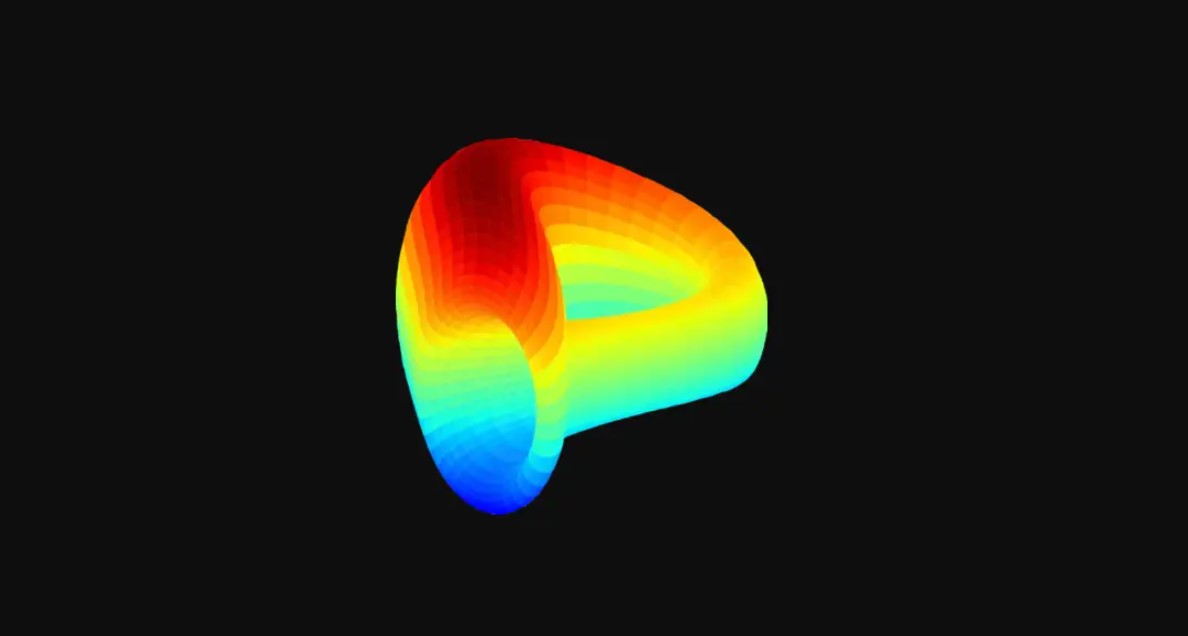

Curve V2, the second iteration of the protocol, was released six months later, in June 2021. It added the capacity to trade between assets that had no correlation with one another. Specifically, we began operating the WETH/WBTC/USDT pool.

Additionally, the new version included a mechanism that would automatically concentrate the liquidity around the price that was currently in effect. Users were able to trade substantial quantities with very little loss due to slippage as a result of this.

How does the structure of Curve tokenomics work?

The CRV token, which is Curve Finance’s governance token, is an ERC-20 token that was launched on the Ethereum network. The primary objective of CRV is to encourage liquidity suppliers by means of income farming, in addition to involving users in the decision-making process regarding protocol-related matters.

The launch of CRV occurred on August 13, 2020, but not in the manner that the Curve team had anticipated. An anonymous software developer was able to independently deploy the token’s smart contract after seeing the program code released in advance on the hosting service GitHub, which was used by the developer.

Because there were no problems during the launch, the team working on the project had no choice but to acknowledge it as official. The maximum number of CRV tokens available is 3.03 billion, and they will be distributed as follows until August 2026:

62% went to the liquidity providers, 33% went to the team, and 5% went to the reserve for the Curve DAO. About a thirty percent annual reduction can be expected in the token issuance pace. Following the initial cut in August of 2021, the daily total will be approximately 633,126 CRV.

Token holders have three options for making use of their tokens:

- vote on ideas within Curve DAO;

- participate in staking and receive fifty percent of the protocol fees;

- raise the yield by up to two and a half times while providing liquidity.

The CRV must be locked out for anything between one week and four years in order to use any of the three functionalities. As a kind of compensation, veCRV escrow tokens are distributed. Additionally, the owner receives just 0.25 veCRV for every CRV blocked for a period of one year. It is not possible to obtain veCRV in a ratio of 1:1 without first blocking CRV for a maximum length of 4 years.

As of the middle of the year 2022, approximately 47.6% of the CRV tokens that are circulating have been locked up. The token’s market capitalization places it in the top 100, and it is traded on the vast majority of the leading cryptocurrency exchanges.

How is Curve Progressing Over Time?

Since it began offering income farming, Curve Finance has become one of the most successful DeFi protocols in terms of both the amount of trading and the locked liquidity it offers.

In January 2022, when it was at its highest point, its TVL was greater than $24 billion, and its monthly trading volume was greater than $6 billion. But by the middle of 2022, despite the fact that the cryptocurrency market has completely crashed, Curve will still be among the top five DeFi services, having successfully blocked over $5.7 billion of cash.

Because Curve offers such a vast amount of liquidity to its users, many other DeFi providers are able to utilize its pools as part of their own ecosystems. Curve Finance is specifically integrated with the 1inch liquidity aggregator, in addition to Aave and Compound, which are two of the largest landing protocols.

In the years 2021 and 2022, in addition to the Ethereum blockchain, the Curve protocol was implemented on a total of nine EVM-compatible networks. These networks included Arbitrum, Aurora, Avalanche, Fantom, Harmony, Optimism, Polygon, xDai, and Moonbeam.

The widespread use of Curve combined with the accessibility of the protocol’s source code has resulted in the development of multiple forks (copied protocols). Both Ellipsis Finance, which is powered by BNB Chain, and Kokonut Swap, which is on the Klaytn network, are the largest of these exchanges.