What Does Return on Assets (ROA) Mean?

You initially need to comprehend what profitability is in general order to comprehend return on assets. Rent-generating capacity, in other words, is what profitability is. It can be taken from natural resources like fossil resources or from real estate. Rent from capital is known as...

You initially need to comprehend what profitability is in general order to comprehend return on assets. Rent-generating capacity, in other words, is what profitability is. It can be taken from natural resources like fossil resources or from real estate. Rent from capital is known as interest, rent from shares as dividends, and rent from business operations as profit.

What is ROA?

When determining how profitable it is to operate in a specific industry, they frequently utilize another indication called marginality, which should not be mistaken with profitability. Margin is the difference between revenue and costs, which is the main distinction in this case (everything that is earned minus everything that is spent in the production process). Margin is essentially the net profit per unit of merchandise. It does not describe how effectively resources are employed in the production process.

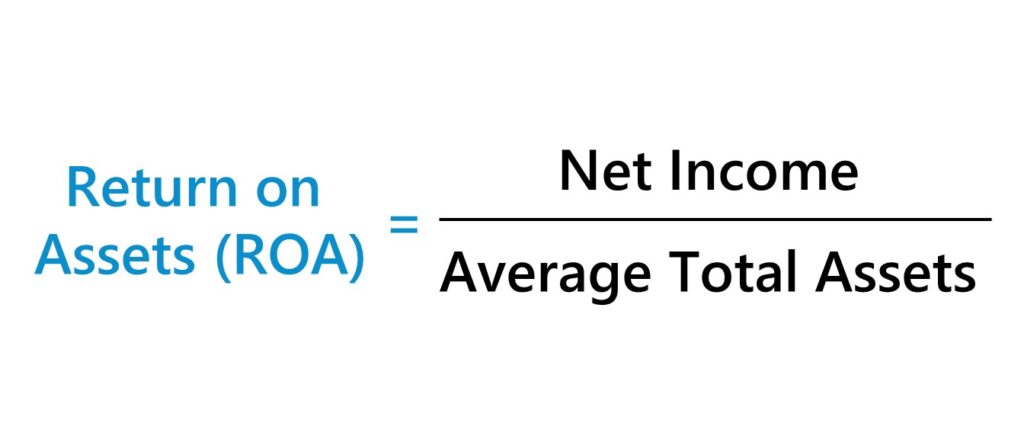

As a result, the return on assets is a relative measure of an organization’s effectiveness that is used to analyze financial accounts and evaluate the organization’s profitability.

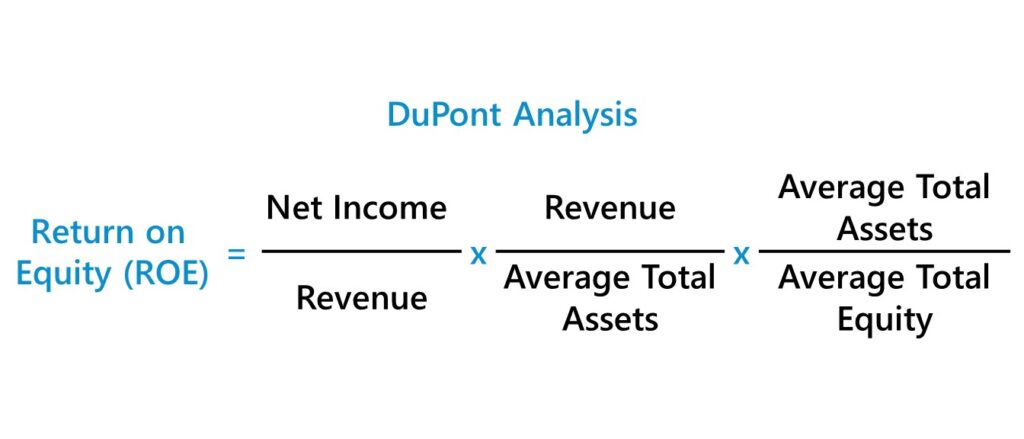

Last but not least, a strange but accurate response to the query “What is the return on assets?” will be this: it is a component of the Dupont formula. Here is the whole thing:

The name “Dupon model” or “Dupon formula” refers to the business that used it for the first time in the 1920s. With this approach to financial analysis, a computation is made by evaluating the important variables that affect an enterprise’s profitability. It is a factor analysis, or the selection of the key variables influencing the effectiveness of the business.

The return on equity, or return on equity, is calculated using this formula.

How to calculate ROA

In contrast to ROE, ROA considers both the firm’s borrowed money and its equity. Therefore, the wider the disparity between the two indices, the more borrowed funds a corporation has. In other words, the return on assets diminishes as the amount of borrowed money rises. Debt and stock make up the company’s assets, which are utilized to fund operations. The bigger the ROA number, the more effective the business is (creating profit with the help of assets). As a result, the business makes more money with less investment.

The return on asset formula itself is much easier to understand:

As a result, the value is determined by multiplying the net profit or loss realized during a specific period by the entire asset value of the company during the reporting period.

What Do Assets Mean?

Recalling what is meant by the phrase “assets,” or the property of the corporation, would be helpful in this situation. They are separated into long-term and short-term in the broadest sense. The former include the company’s fixed assets (such as its real estate holdings), its intangible assets (such as its brand value and customer base) as well as investments in authorized funds and the equity capital of other companies and subsidiaries.

Short-term assets include money in the company’s accounts and cash desks, short-term receivables, and finished goods and semi-finished products utilized in its production (when not the company owes someone, but someone owes the company).

It’s crucial to combine two different financial sources—your own money and borrowed money—when creating assets. As a result, it makes no difference when establishing assets whatever ruble was borrowed or given by the business’s proprietors. The profitability indicator’s main purpose is to evaluate the effectiveness with which each unit of raised money was utilized. The amount of interest payments made before to income tax is thus not included in net income.

Return on net assets is another closely related economic metric that should not be confused with ROA (RONA). This coefficient demonstrates the organization’s capacity to increase capital through the return on each unit of money invested by the owners and the logic of managing the capital structure.

Since the net profit per owner investment unit reveals the overall success of the company as an investment object, they are always motivated to raise this particular indicator. RONA can also be used to calculate the dividend payout percentage. Last but not least, the higher this indicator, the more rapidly stock values are increasing on the stock market.